These 10 tips for picking better traders on ZuluTrade is our field guide for sifting through the thousands of traders on ZuluTrade. This includes both important trading stats we’d look at first and also some red flags to be aware of.

All in all this is not a strategy for picking traders, but a practical guide to go back on and help you simplify shortlisting of potential traders to copy.

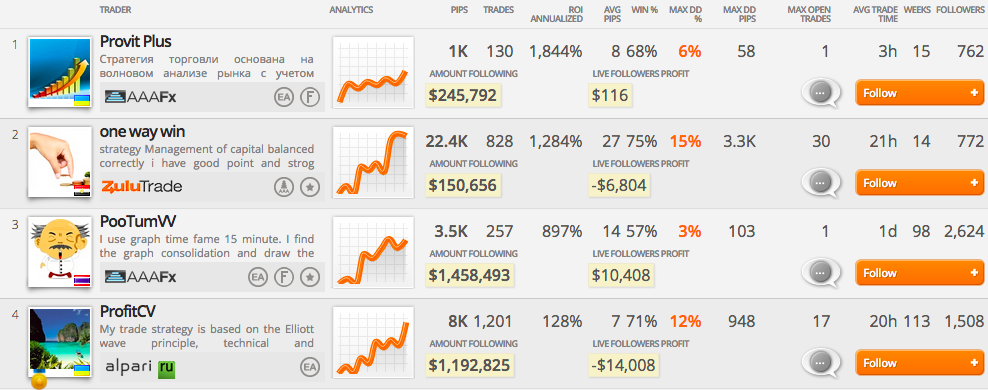

Selecting traders on ZuluTrade can seem an easy task at first, especially given the very impressive list of top traders all boasting fantastic results, but if you’ve spent any significant amount of time or money on ZuluTrade, you’ll know that this unfortunately isn’t the case. Top traders have a remarkable track record of not remaining at the top for too long and whilst this can be due to a variety of reasons, one thing is clear – don’t just blindly copy the top traders as recommended by ZuluTrade’s algorithm or you’ll very possibly be part of their drop from the top.

Of course we’re not saying that hard times isn’t to be had. Even the most successful traders will experience highs and lows in their performance, but it’s exactly for this reason that seasoned traders on a temporary low should not be overlooked and likewise novice traders on a temporary high should be identified and avoided.

Of course we’re not saying that hard times isn’t to be had. Even the most successful traders will experience highs and lows in their performance, but it’s exactly for this reason that seasoned traders on a temporary low should not be overlooked and likewise novice traders on a temporary high should be identified and avoided.

Minimising risk via diversification is the name of the game and, as mentioned in our last article, The growth of Social Trading Networks, this holds true for social trading networks as well.

1. Write down what you’re looking for

This is a very important first step and should at least be done to some degree before you even start looking at any traders on ZuluTrade.

As with any endeavour in business a basic plan is important and it’s all too often that investors blindly start browsing traders profiles and make decisions based on some metric that appeals to them in that moment. This simply doesn’t allow for intelligent diversification and will make tracking the performance of a portfolio difficult.

Some points to consider writing down might include the following:

How much risk are you looking to take?

This isn’t a matter of what you’re “up for”, but rather deciding how many traders you’d ideally want in you portfolio, what lot sizes you’ll be trading with and as a results of these factors, how much money you can afford to have riding on a single trader. i.e. Some very basic money management.

Whether you are looking for frequent short term trades, or are you happy to copy traders that hold on to trades for maybe a month at a time? This is going to depend greatly on your own preference & personality, and not necessarily be better one way or another. This will also impact the broker used by the trader and the average slippage on trades. If you opt for traders that trade often, then minimising slippage should be very high priority.

It’s also worth deciding on any other key points that is specifically important to you and the type of portfolio you’re looking to build. For example whether a trader trades with their own money. This can have positives and negatives and should be determined again by the type of trader. Trading with real money could be considered great as the trader will be more cautious with his/her own money, but will also increase emotional attachment, a traders worst enemy!

There’s a lot to consider beforehand and whilst it’s not all necessary, try to at least establish an idea of what you’re looking for. It’s almost always better to come prepared!

2. Ignore new traders

Now this may seem harsh to simply say exclude any new traders, but realistically without enough data, you cannot make informed decisions on whether to copy a trader.

So what constitutes a ‘new’ account? Well, unfortunately there’s no magic number and with the concept of social trading networks being relatively new, you won’t be finding anyone with a solid 10 year track record either.

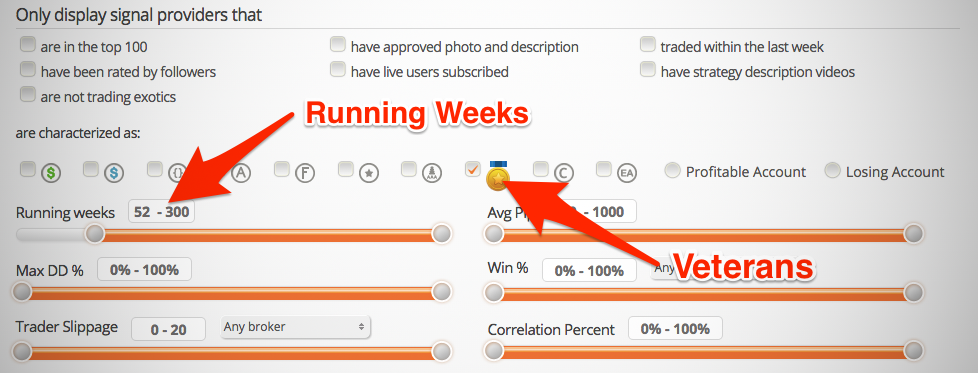

We feel that a minimum of 52 weeks (1 year) is a good starting point, but essentially this will depend on the traders that remain once you’ve filtered all the unsuitable traders as per your pre-decided requirements.

It’s also important to take into account the total number of trades a trader has closed during this time. 2 Traders with both 52 weeks trading isn’t equal if one of them closed 10x as many trades as the other. This most likely gives the trader with more trades under his belt the upper hand when it comes to experience.

ZuluTrade also offers the convenient option of selecting what they call ‘Zulu Veterans’. These are basically traders that has been with the ZuluTrade network for over 2 years and has stayed active and within the top ranking, but as expected there isn’t many of them.

3. Don’t try and reverse losing traders

Whilst the strategy of simply reversing positions on losing accounts might seem simple, this can get very costly very quickly. Remember, a trade opens as a loss, so racking up losses is very easy. A reversed version of that same trade however will need to first cover the spread in order to be profitable and will never be an exact reversal of the copied account.

We’re not saying this strategy cannot be successful, but we’re yet to see it and it isn’t something we’d recommend testing with any significant amount of money.

4. Bank more pips per win

A prevalent theme on ZuluTrade is traders taking very small wins in an attempt to up their win ratio. This is largely because traders only get paid for profitable months, so making a profit is more important than how much profit. This is however also very common in trading in general and one of the fundamentals when it comes to successful trading – let your profits run.

So what about legitimate scalpers? Scalping can be a very successful strategy, but it combines small profits with very small losses and this is where the difference comes in. When traders abandon their non-scalping strategies for the sake of getting paid commission, accounts become fragile and run dry very quickly.

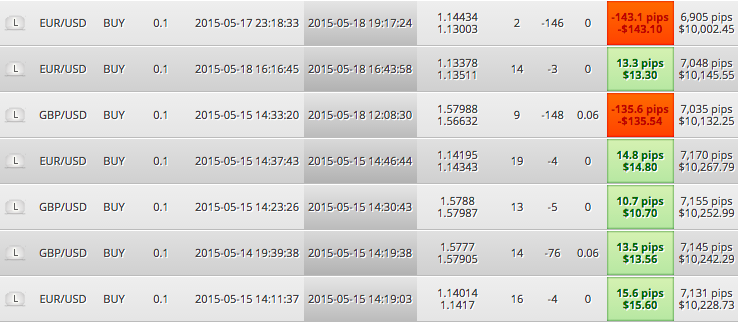

So be sure to check a trader’s losing trades as they will most likely tell you more about a trader than their winning trades. If a trader consistently takes 5 – 10 pips profit and occasionally takes a 200 pip loss, that isn’t great. It simply screams that this trader isn’t following a strategy and whilst an account might be performing very well, it only takes a few of these big losses in a row to destroy 100’s of small wins!

Therefore, aim for traders who consistently take double digit wins and make sure that average losses aren’t significantly bigger than the average wins.

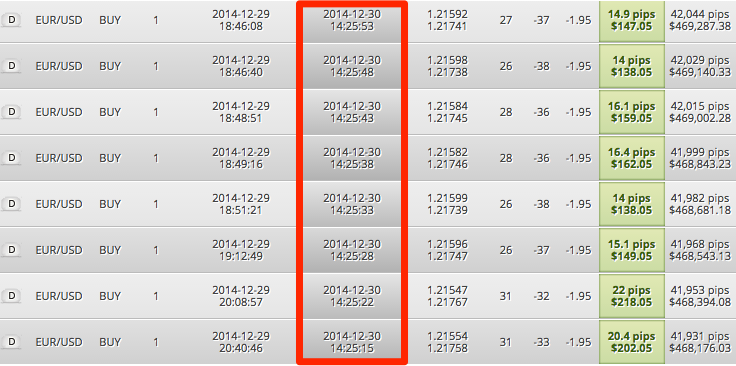

5. Beware of multiple consecutive trade lots

This is all over ZuluTrade! Basically, because of the ZuluTrade revenue model traders benefit immensely from opening multiple individual lots of a single trade, and whilst this is great for the traders, it essentially ups the allocated lot size per trader. This can of course be overcome to a degree by setting max trades per currency or max trades per trader, but it’s less than ideal.

Where this pattern get really dangerous is when traders employ this method in order to make up for floating losses. Say a trader opens a trade and it goes against them, they might open another lot of the currency pair in order to mitigate the floating loss of the first trade.

This strategy can be spotted easily by looking at past trades and should definitely be treated with caution. A position that keeps going south with increasing lot sizes can very quickly turn into a disaster for any account.

6. Don’t get hung up on win percentages

The idea of copying a trader that wins 90% of trades seem great, but as this article by Nial Fuller points out, winning percentages are somewhat irrelevant!

A trader taking 9 losses at 5 pips each and a single win at 100 pips will still be very profitable, despite having only a 10% win rate.

In fact such a trader should be perceived as strong minded and sticking to their strategy. A definite green flag!

Unfortunately, as mentioned previously, ZuluTrade doesn’t incentivise losing months, so high win percentages still take priority with many traders.

7. High drawdowns will paralyse your account

This might be one of the more obvious points, but avoiding excessive drawdowns is huge! Not only will these high drawdown positions hog your available cash, but it’s also often indicative of a trader with hope or desperation rather than a strategy.

Again, the percentage isn’t an exact science and the traders trading style will largely dictate this, however a trader with consistently small wins and large drawdowns is almost just as bad as a trader with large losses. That said, if you’re looking at a trader that holds positions for months at a time and takes 200+ pips on a trade, then a larger drawdown becomes more justified.

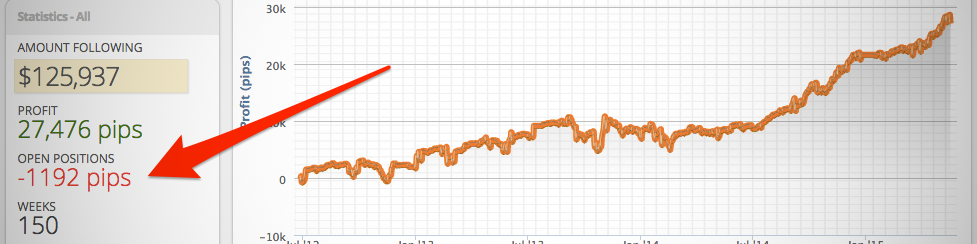

8. Look out for open trades

When researching a traders profile, be sure to check for any open positions and compare the time these have been open for to the traders average trade time.

Traders that don’t cut their losses and ride losing positions often indicate an overly emotionally involved trader and should send alarm bells.

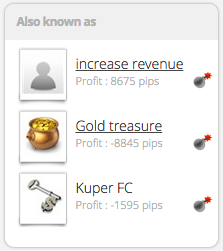

9. Check previous trade profiles

Many traders on ZuluTrade have destroyed previous accounts and simply created a new identity to begin afresh. Luckily ZuluTrade makes it easy to spot these and will even indicate whether the account went bust.

Many traders on ZuluTrade have destroyed previous accounts and simply created a new identity to begin afresh. Luckily ZuluTrade makes it easy to spot these and will even indicate whether the account went bust.

This absolutely does not mean that someone with previously blown account is to be avoided, people learn and get better, but it’s worth being aware of and even checking for any correlation between those old accounts and current accounts.

Much like losses, old accounts that went bust can tell you a lot about a trader and can be a very good reference to whether a trader is adapting his/hers trading strategy to improve on past performance.

10. The graph is your friend

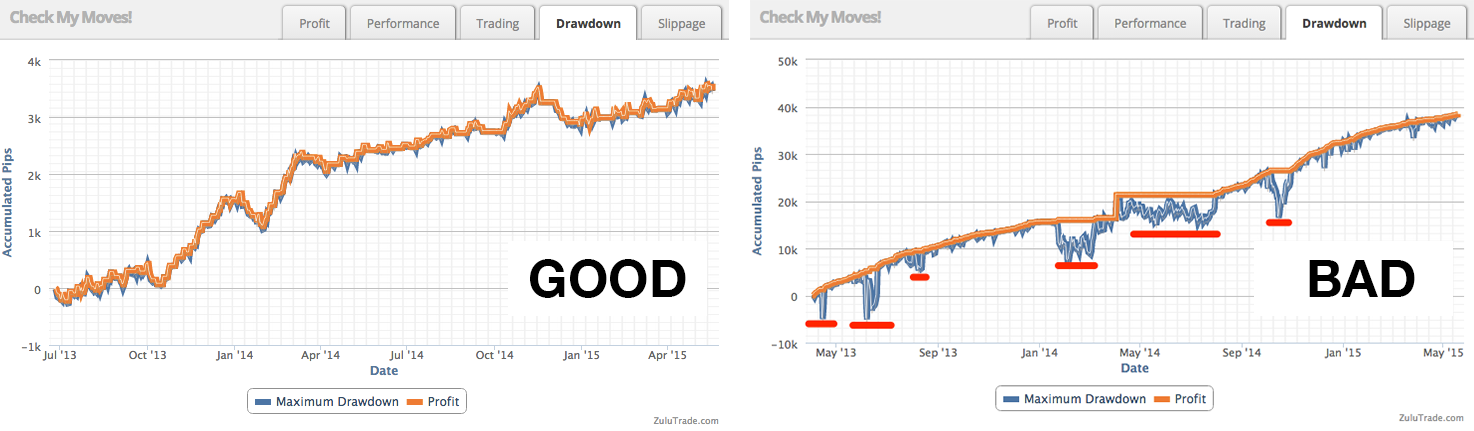

Finally, always look at the graphs ZuluTrade provides. The human brain responds best to visual input, so looking at a simple chart can give even the least number orientated person a good understanding of just how well a trader is doing.

The drawdown graph is particularly useful as this will also give you a quick indication of drawdown vs profit and point out erratic trading behaviour.

We hope these 10 practical tips will help simplify the absolute most crucial task on any social trading network, choosing the right traders to follow. For more information on the ZuluTrade social trading network be sure to check out our ZuluTrade review.

PS: Remember, trading carries significant risk so never risk more than you can afford to lose!

Leave a Reply