Trading revolutionised by the internet

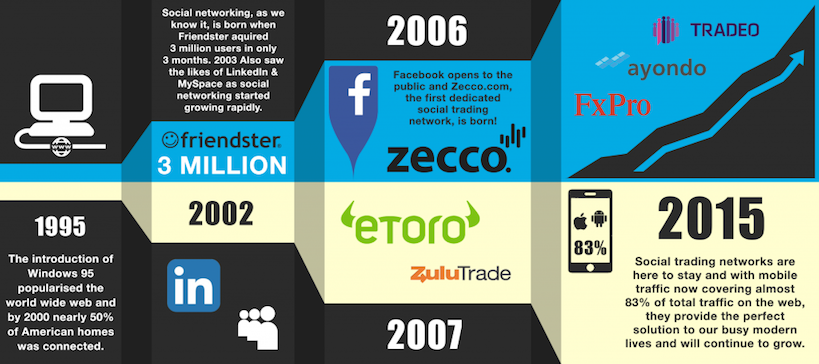

Although the world wide web in it’s most primitive form was conceived in ’69, it wasn’t until 1995 that Windows popularised the idea of home internet with the launch of Windows 95 at which point we saw sites like Amazon and Yahoo! pop up.

At this point the instant access to markets really started to empower average Joe by allowing all those connected to share information and get access to real-time financial news.

That said, resources was still pretty far and few, opening a broker account was a process in itself and getting started certainly required a descent amount of knowledge.

Birth of social networking

Although sites like GeoCities and SixDegrees are heralded as the the fist social networking sites, it was really only in 2002 when Friendster grew to 3,000,000 members in 3 months when our modern notion of social networking was born.

We quickly saw sites like LinkedIn and MySpace follow suite and then in 2006 we saw the real game-changer when Facebook opened to the general public after enjoying huge success as a Harvard-only network.

Social networking was now becoming a very familiar concept and people were sharing everything and anything, including financial tips and strategies which is why 2006 also saw the first social trading network, Zecco.com.

Zecco.com did not have any of the features, like copy trading, that make social trading today, but it was the first dedicated trading community where users could focus solely on sharing and developing their knowledge of the financial markets.

This new concept of trading very quickly became popular and in 2007 we saw the likes of ZuluTrade and eToro, although still in it’s questionable early gameified form. This was all very quickly followed by the likes of many popular social trading networks like Currencee, Myfxbook, Tradeo, Ayondo and many more.

Social trading now allowed investors to not only share and discuss, but simply copy trades from other traders. An effortless task that allows anyone to dabble in the markets and learn from more experienced traders. The massive growth of social trading networks in the late 2000’s was also boosted by the growth of mobile technology, meaning that users was no longer tied to their desks monitoring open trades, but could stay informed whenever and wherever.

Effects on the markets

An interesting idea around social trading is that a successful strategy will eventually lead to too much volume being traded ( too many traders copying it’s trades), and will ultimately lead to it’s own downfall as this could create spikes in supply/demand.

Whether this happens depends of course on a number of factors and one would think that in high volume markets such as Forex, this would be much less likely.

A 2013 study by MIT, concluded that investors copying or being involved in isolated social circles or simply copying 1 or 2 traders, performed significantly worse than those that diversified both their connections and the number of traders they copy.

Either way, despite their massive growth, social trading networks are still in their infancy and this will be a very interesting development over the next few years as millions more traders & investors join social trading networks.

Future of social trading networks

Social trading networks are constantly innovating and despite all the new features we’ve seen in the past year or 2, it’s still early days. Whilst originally the vast majority of social trading networks was restricted to trading Forex, a number of them have now introduced stocks, commodities and indices. ZuluTrade has even gone as far as introducing Binary options to social trading!

As the MIT study suggests, we’ll certainly see the future of social trading become a much more sophisticated industry with investors diversifying across multiple networks and possibly even the introduction of tools to manage such diversification.

If you’re looking to diversify your portfolio by opening a second social trading account or just getting started with social trading, be sure to check out our reviews of the best social trading networks.

Leave a Reply