Pros

- Low spreads, no extra commissions

- Very low slippage

- Advanced security approach to clients’ funds

- No fees to third-party brokers

- Traders earn commissions for performance and risk management techniques

- Low starting deposit

- Available demo account

- Automated trade copying

Cons

- Lack of social communication features

- Not so many high performing traders

- No possibility to download history of transactions

- Impossible to see the contribution of traders towards the portfolio

Important! Please note that we strongly advise against signing up with Ayondo. Read the comments of the people scammed by Ayonado to find out why:

This review is an opinion that previous clients of Ayondo hold based on a certain set of facts: Ayondo used high-pressure sales tactics including loyalty bonus which is only available by a certain deadline, but is offered again and again with new deadlines each time, the bonus is not free money it wasn’t possible to ever meet the terms of the bonus before the account was wiped out, ever heard of the ‘’Carrot & Stick’’? The Ayondo sales rep is very determined having received approximately 311 emails and phone calls eliciting the transfer of up to £100k to open an account the sales rep became frustrated when the transfer was delayed and challenged the client requesting that he find another manager to sign the funds release, regulatory forms were also filled out for clients with Ayondo staff handwriting.

The promises of making money and protecting capital were very convincing, with illustrations and ‘evidence’ but remember the website is presented to sell you a product and naturally these impressive graphs, trading statistics, balances and portfolio history isn’t showing the whole picture plus it’s design is detracting from betting by looking like sophisticated ‘trading’.

The Ayondo Sales Rep told one client when questioned about spread betting that it’s really trading which originally came from Hedge funds but Ayondo is a spread betting company it’s not trading and it’s certainly not ‘social trading’ because you cannot interact socially with any of the ‘traders’. The best way to explain Ayondo is providing people that sit at home and place bets with a platform to fund their betting habit at your expense, if you were aware that’s where your money is being diverted would you agree to the risk? There was a pattern of very large bets placed large money clients accounts and because the people sitting at home placing bets are rewarded if they win or loose the higher the exposure the higher the reward. This exposure can be very

There was a pattern of very large bets placed large money clients accounts and because the people sitting at home placing bets are rewarded if they win or loose the higher the exposure the higher the reward. This exposure can be very quick, before you can blink, the guy at home has his reward whilst you have your large loss exposure. There are very few safeguards in place to avoid betting losses on the Ayondo platform, there is no protection in place for being overexposed by the number of bets placed, or overexposed by the size of the bet. There is no default balance protection to safeguard a certain percentage of your balance and there

There are very few safeguards in place to avoid betting losses on the Ayondo platform, there is no protection in place for being overexposed by the number of bets placed, or overexposed by the size of the bet. There is no default balance protection to safeguard a certain percentage of your balance and there is no stop loss features available on the traders in your portfolio. Indeed concerns about these money management problems have been raised on other review sites along with the fact that Ayondo does not appear to be a ‘social trading’ platform system. The Ayondo platform also suffered pricing irregularities in a clients experience resulting in losses. The Ayondo sales rep on one occasion admitted that multiple traders were really the same trader following erratic

The Ayondo platform also suffered pricing irregularities in a clients experience resulting in losses. The Ayondo sales rep on one occasion admitted that multiple traders were really the same trader following erratic behavior by one of the traders causing multiple blowouts. When things go wrong with Ayondo such as requesting the closing of your account the company got into arguments and took weeks to transfer the funds that were left.

One client lost approx £72k with Ayondo. The FCA has advised that the FCA supervision team responsible for Ayondo Markets Limited is investigating.

Below is an outdated review which you should disregard. It is only kept for SEO purposes so this page could be seen by more people.

Ayondo Scam

Ayondo is a social trading network that was established in Germany in the year 2009. Since that time, Ayondo has proved to be one of the leading social trading platforms not only in Europe, but on the global scale.

In our review, we would like to investigate all ins and outs of Ayondo services to give a crystal-clear picture whether Ayondo social trading is worth your precious time and money. Let us begin.

Account Setup

Live accounts:

Ayondo provides two main live accounts dedicated to social trading: Follower Account and Top Trader Account. The choice basically depends on what you are leaning to most – following the successful performance of traders with great portfolios or moving up in ranks among the best signal providers and profit from being followed.

When preparing this Ayondo review, we discovered another live account to choose – Spread Betting Account, where you just bet whether markets will rise or fall.

Live accounts can be opened in 4 currencies: EUR, USD, CHF and GBP. The minimum deposit requirement is 100 USD/EUR/GBP/CHF accordingly. At live trading accounts, you are able to leverage your deposit up to 1:200.

Demo account:

Ayondo has provided traders with an opportunity to test their skills in almost real market conditions. Ayondo demo account is available for 21 days. After these days, your demo account will be expired. Note that only one demo account per one Ayondo account is allowed. You can trade using the following currencies: EUR, USD, GBP, SEK and CHF. On a side note, both followers and traders are eligible to utilize demo account features.

Capital Protection

We are glad to inform you that Ayondo provides all real account owners with the Loss Protection feature. This feature is absolutely free and customers are able to adjust their Loss Protection as they see fit. For example, imagine that you invested $2,000 in your Follower Account and do not want to risk more than $300. Following the logic, you will prefer to set the Loss Protection to $1,700. Hence, if your net liquidation value reaches the pre-defined level, all the trades will be closed. Additionally, no further trades will be executed without your permission.

As the part of insurance policy, Ayondo social network provides a protection of personal accounts’ deposits for up to £500,000. In addition, all clients’ money is held in segregated bank accounts.

However, protection of funds is mostly granted on the level of accounts, yet there are no advanced features to protect capital invested in trades except for basic risk management tools.

Brokers & Spreads

What is basically good about Ayondo is that you do not deal with separate partner brokers, while joining the network. In fact, Ayondo has delivered their unique and fully integrated broker solution – Ayondo Markets, which is the best broker for Ayondo you can get.

Spreads offered at Ayondo Markets are more than just acceptable – as low as 2 pips for EUR/USD pair, to give an example. Moreover, you do not pay any commision to third-party brokers. You just pay the spreads for following and copying other traders. No hidden fees. You can see the example of spreads on FX below:

Trading Platform: Following Top Traders

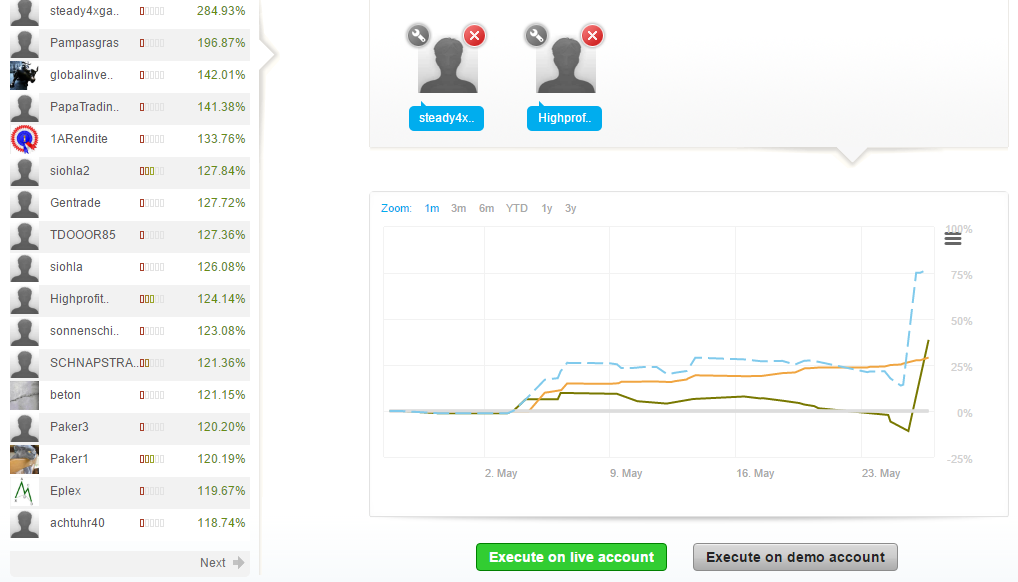

Once you join Ayondo Social Trading Platform by opening the Follower account, you will be provided a choice of more than 1,000 traders whose performance you can follow and copy. Although there are not so many of them right now, you can still find good traders with low risk and high reward strategies.

Ayondo has developed a comprehensive trading platform. Here is the list of tradable instruments:

- Forex – 30 pair

- Major Indices

- Interest or Bond rates

- Commodities

- Individual Company Shares

Technically, Ayondo has introduced a broad range of assets to trade. Thereby you can substantially diversify your trading portfolio. All you need is just to follow different signal providers to build a proper one.

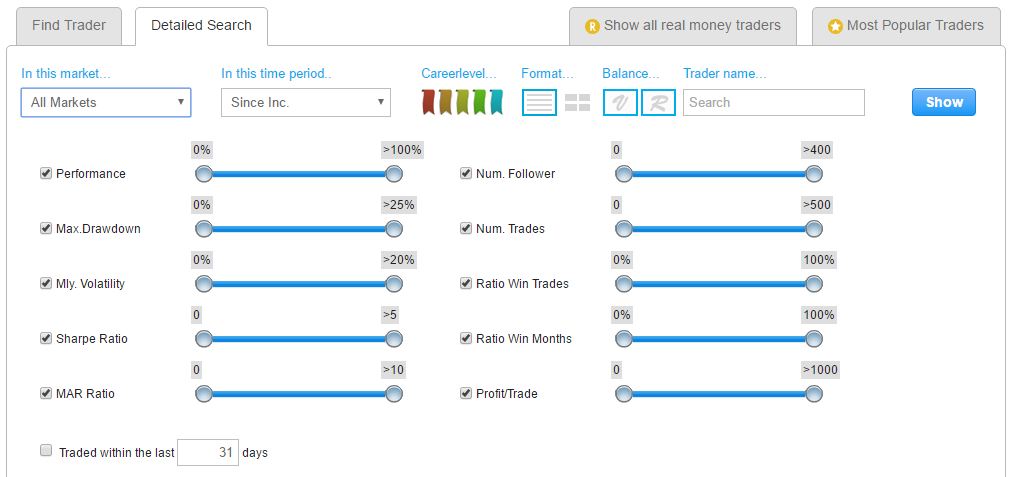

In order to facilitate your search for professional traders, Ayondo investment network permits you to apply 14 parameters to pick the one who seems most suitable for you. These parameters, or should we say filters, include the following: Performance, Max. Drawdown, Win Ratio (Profit/Loss %), Volatility, Number of Followers, Trades per Month and so on.

After applying the filters, you will be displayed the rankings list. If you want to learn more about particular traders, it is enough to check their profiles at Ayondo. The information presented there is pretty self-explanatory, although if you still need more data to be analyzed – then you can read full transaction history and view currently open trades of the signal provider you are interested in. However, an apparent drawback is that you cannot download the trade history in Excel format. It is not critical for making money at Ayondo social trade, though you will not be able to perform external analysis.

Risk/Money Management

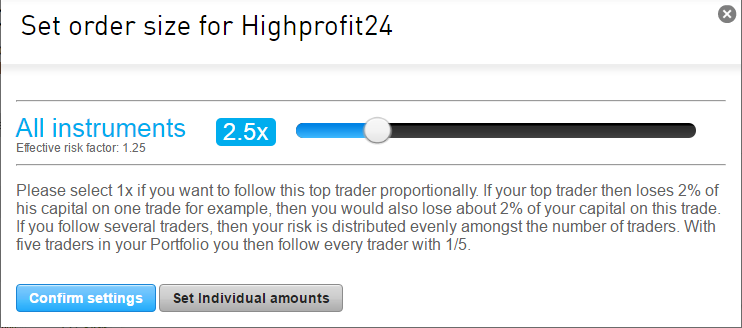

As you might have guessed, there is a certain limit of traders whom you can include in your portfolio – up to 5. The default order size for each trader is set as 1x. This works perfectly if you wish to follow each trader proportionally. For instance, if your trader loses 3% of his capital on one specific trade, then your capital invested in this trade will also incur losses of 3%. In case you follow several traders, then your risk is equally distributed among the actual number of traders. Generally, you can adjust the order size in accordance to your risk management strategy (0.5x, 1x, 2x, 3x, 4x, 5x, 6x, 7x, 8x, 9x, 10x). Moreover, you can even set the order size for each asset in the trader’s portfolio.

Thanks to the intuitive Ayondo investment platform interface, you can track your success once you have started copying trades from the signal provider. Beside observing your win ratio, it is possible to view all open positions. If your trading experience tells you that the position will end in loss – you can manually close it.

It is also important to admit that you can modify the positions that were previously generated by the selected Top Traders. This means that you can change the Stop-Loss and Take Profit levels in any way you prefer.

Slippage and Follow the Followers

Some social trading platforms have problems with slippage. In copy trading, slippage is referred to as the difference in opening/closing price the signal provider you copy gets and the price you actually get. Checking slippage is not always a simple task. However, our analysts spent some time to make a conclusion that slippage at Ayondo is miserable – less than 1 pip per each trade cycle. Good synchronization of traders’ and followers’ performances prompts quite low level of slippage.

Ayondo copy trade is currently developing its brand new feature called “Follow the Followers”. The idea behind this concept is enabling all users to copy profitable followers’ accounts. However, it is unlikely that we will see this feature released in the nearest future.

Traders & Community

The main reason to possibly call Ayondo scam right now is almost full absence of social interaction between followers and traders. It is currently impossible to rate traders and chat with other followers via forums. Facebook and Twitter integration are disabled as well.

Though you might create and post reports concerning the monthly performance of the selected trader in his trading profile, this still will not provide you with the sufficient feedback to observe real changes in your account.

Nonetheless we have not noticed any serious Ayondo complaints regarding the lack of community interaction.

Trading Platform: Being a Top Trader

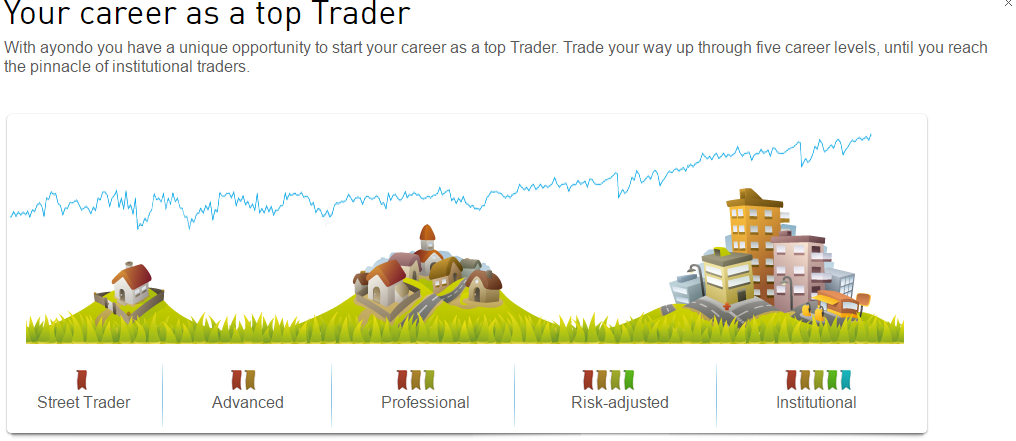

At Ayondo everyone can become a Top Trader. You just need to prove your trading proficiency by meeting the performance requirements. Literally, you have to trade during 1 month and afterwards your achievements will be evaluated. For instance, you are expected to complete a minimum of 15 trades within 30 days. Your max drawdown cannot exceed 25% and the overall performance after 1 month must be over 1,0%.

In case of positive results, your username will appear among the Top Traders’ list. At this stage, Ayondo will immediately rate you as Street Trader. It is the first out of 5 career levels. You can see other levels at the image below:

Your promotion in Top Trader career depends on two main factors: earned profit and maximum drawdown. Traders are paid higher Ayondo fees as they improve their status. However, it is not a safe harbour. Your performance is monitored on a regular basis and that is why you have to keep it at a decent level. The trader compensation system includes not only rewards for successful performance, but also for the professional approach to risk management. Furthermore, you can also earn up to $5 per lot produced by every person who follows you.

It is vital to mention that Top Traders have their special platform called TradeHub. Most Ayondo reviews admit that TradeHub is quite a good platform, easy-to-navigate and customizable. In case of some problems with understanding the platform, you are encouraged to read manuals that explain everything gradually. Another advantage is the availability of TradeHub mobile apps downloadable at Android, BlackBerry and iOS devices. We should also warn you that trading robots are not supported at TradeHub.

Funds Management

In order to fund your account at Ayondo you can use the following methods:

- Credit/Debit cards

- Wire Transfers

Credit/Debit cards include Visa, Visa Electron, MasterCard, Maestro. American Express is not accepted here. Furthermore, Ayondo copy trading applies 3-D Secure technology to ensure another security layer for transactions.

Take into account that all payments made by all credit cards, MasterCard debit cards and non-UK debit cards will be charged with a 2% transaction fee. As for the wire transfers, see the information below:

Withdrawals can be made in the same way as the deposits. To withdraw funds using cards, you just have to send a withdrawal request. However, if you wish to apply for a bank transfer then you have to contact customer support.

After the withdrawal request is processed, you just have to wait up to 5 business days to receive your payment.

Customer Support

We have read a lot of positive Ayondo opinions regarding customer support, because it is multilingual and easy to reach. To contact customer support you can use phone and email. Ayondo supports 5 languages, including English, German and Russian.

In addition, you can learn many tips for Ayondo in the well-developed FAQ.