Pros

- Good user-friendly website

- Decent leverage

- Diverse account types

- Low minimum deposit requirements

Cons

- Unfavorable withdrawal requirements

- Wide spreads

Many traders may have already heard about Trade.com and its multiple years of experience in the financial markets. However, despite its multiple years of presence in FX, stocks and etc, the company still requires updates every now and then. Exactly because Trade.com has gone through several upgrades over the years, it warrants a completely new Trade.com review from our side as well. Be it changes in the website design or simple regulatory compliances, it doesn’t matter. Whatever is new, needs a new page to explain.

Therefore, we will be looking at Trade.com at a completely different angle in this review. Meaning that we will not consider all of its past selves and the years of experience it has gone through. We will look at the company with today’s standards and today’s regulations. Should it fail to stay competitive in either of those aspects we’ll be quick to point it out.

However, the main focus, will, of course, be to say if Trade.com can be trusted with its new version and current conditions. Without further ado, let’s begin the intrigue.

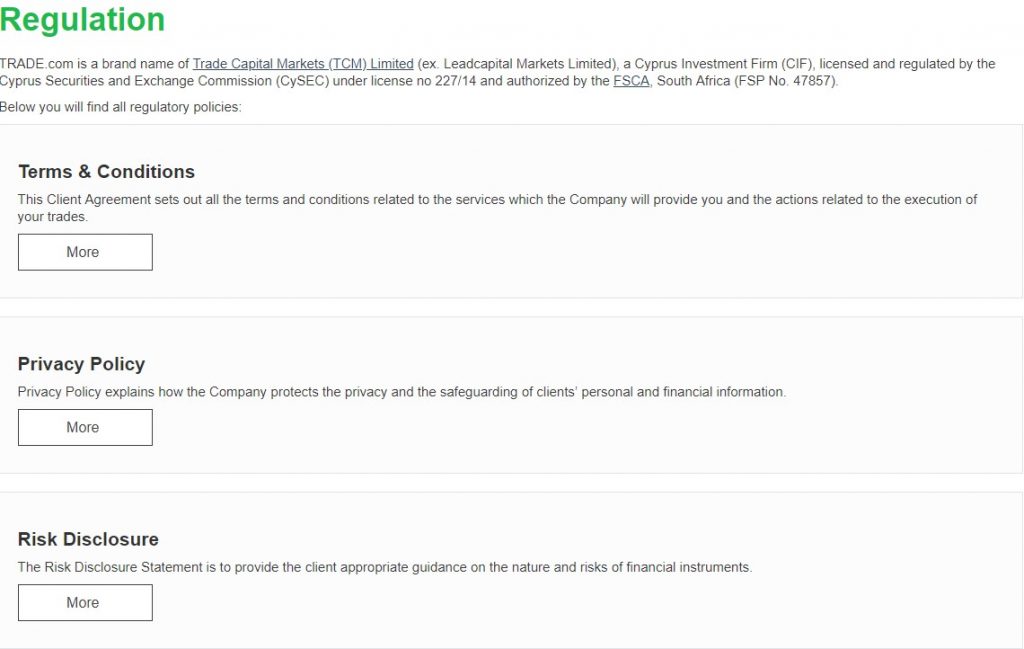

Trade.com review – legal documents

Let’s stick to our plan of not considering Trade.com’s previous versions, be it websites or trading conditions. Looking at the website now, it needs to be said that having the legal documentation easily accessible through a comprehensive page on the footer of the website is quite pleasant.

In fact, Trade.com is one of the few Forex brokers that have titled their legal documentation as “Regulation Pack”, indicating that the company is regulated in more than one jurisdiction.

When it comes to the legality of Trade.com’s operations, its legit nature simply cannot be questioned. The documents, transparency, and confirmation from both CySEC and FSCA websites make all the Trade.com scam or fraud accusations redundant in the face facts.

The license with CySEC allows Trade.com to operate in all of the EU member states, thus having to comply with ESMA regulations for CFDs and Binary options, which it does without any flukes.

However, with the FSCA license, it has the option to offer additional leverage and benefits to its South African customer base. Therefore, if you see that there are two different sources saying two different things about leverage and available conditions, know that they may be trading on different platforms.

Is Trade.com legit? Do they comply with EU laws?

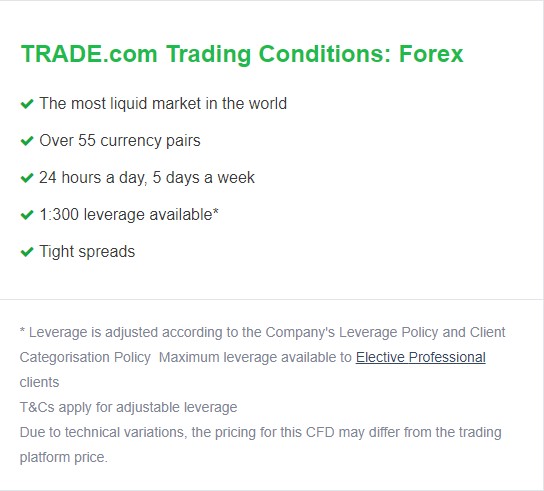

When we talk about EU law compliance we generally mean the restrictions imposed on CFD by the European Union’s financial regulator, ESMA. According to their restrictions, there’s a 1:30 leverage cap on major currency pairs and further lower caps on other assets.

Honestly, when we first took a look at the updated conditions for Forex CFD leverage we thaught we landed on some kind of Trade.com fraud page or something because of how much of it was being shown.

However, we quickly realized that Trade.com has combined information for both types of customers. Meaning customers from the EU as well as outside, which is why the leverage cap is shown as 1:300. Customers from outside of the EU can use leverage 1:30+ while EU customers are restricted to it.

The AML and KYC guidelines are also very clearly indicated, making Trade.com one of the most transparent brokers we’ve had the chance to review. but now, let’s start looking at the conditions with a bit more detail.

What are the trading conditions?

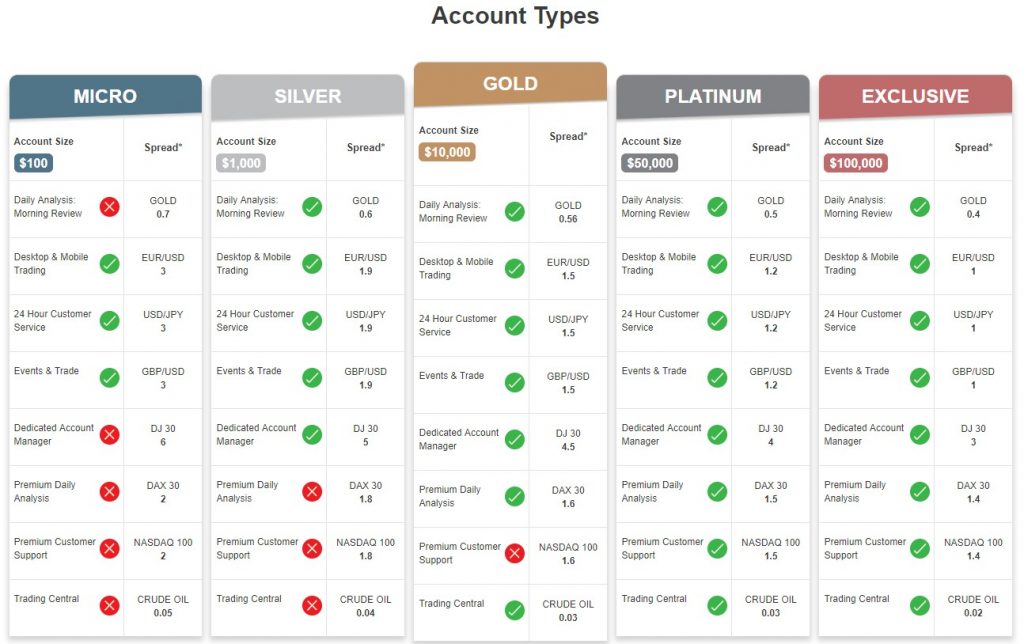

The trading condition varies from account to account, therefore we need to mention the ranges rather than the universal numbers because there simply aren’t any.

Remember that Trade.com account types come in five different shapes and sizes, therefore the benefits and the profitability of each vary drastically. Here’s how the general picture looks like.

Spreads

Condireding the fact that Trade.com focuses more on CFDs, their spreads should be as low as possible simply because of all the fees and commissions that accompany CFD trades. However, that is not exactly the case. Spreads on major currency pairs with Trade.com start from 3 pips all the way down to 1 pip on the most expensive accounts. This is not very trade-friendly in our experience as smaller accounts should have lower pips or at least equivalent to larger ones due to better profitability and chance at growth.

Leverage

We already mentioned the leverage in this Trade.com review, but it was only for the major currency pairs, the broker has a lot more financial assets than that. For example, the leverage offered on stocks, commodities, and cryptocurrencies are displayed exactly how they’re supposed to be under ESMA regulations. Stocks are 1:5 or 1:10 and crypto as 1:2. Getting anything higher than that would violate ESMA policies and not be too healthy for the traders outside of the EU jurisdiction as well.

Trading Software

There are two trading platforms that customers can use. The MT4 and the WebTrader platforms. The MT4 is like a throwback for those who want to trade like in the olden days, while the WebTrader is more customized and designed for additional features, or at least a better user-friendly interface.

We usually get quite nervous when brokers use WebTrader platforms, as it can sometimes be manipulated, but considering that Trade.com is a trustworthy brokerage, it’s safe to say that nothing of the sorts will ever happen. An extra plus for the diversity as well.

Account Types

There are five types of accounts on Trade.com, which is a huge advantage for the vast array of traders wanting to apply. Veterans can easily migrate over to Trade.com and beginners have the chance to start without investing too much as well.

Sure the benefits such as individual signals, education centers and etc are different on each account, but the diversity is still commendable.

Minimum deposits range from $100 to $100,000 respectively. The account types are called: Micro, Silver, Gold, Platinum and Exclusive.

Trade.com withdrawals and deposits

In terms of withdrawal methods, there are quite a lot to choose from. Things like Wire transfer, credit/debit cards, Neteller, Skrill, and various other platforms are all accepted.

Unfortunately, there are fees attached to the withdrawals if they are below the minimum requirements. The minimum requirements are $20 on everything except Wire transfer. Wire transfer comes with a $100 price tag. Should a withdrawal be requested for anything below this amount it will warrant a $10 fee on non-Wire transfer requests and $50 on Wire transfer requests.

Is Trade.com worth it?

Compounding all of the information we’ve gathered about Trading.com it’s a bit hard to determine if it’s a universally beneficial brokerage. When it comes to beginners, the $100 entry price is very advantageous, but for veterans, the $100,000 price tag is a bit steep. When it comes to legal documents, it’s safe to say that Trade.com is legit in all shapes and forms.

We suggest you try out the demo version first just to get the feel how the broker handles their newbies and only then commit to a live account.